Crypto Adoption, Barriers to Entry, and Consumer Attitudes

This report shares statistics on global adoption, barriers to entry, and attitudes around cryptocurrency.

We analyzed a survey of 29,293 adults in 20 countries to learn more about the attitudes, drivers, and adoption of crypto.

First, we established a benchmark for how much people know about cryptocurrency.

Then we looked at why people do or don’t own crypto.

Lastly, we examined how people feel about the role of crypto in the future of finance and the global economy.

Thanks to Gemini for providing the data for this report.

Let's get right into the data.

Here's a Summary of Our Key Findings

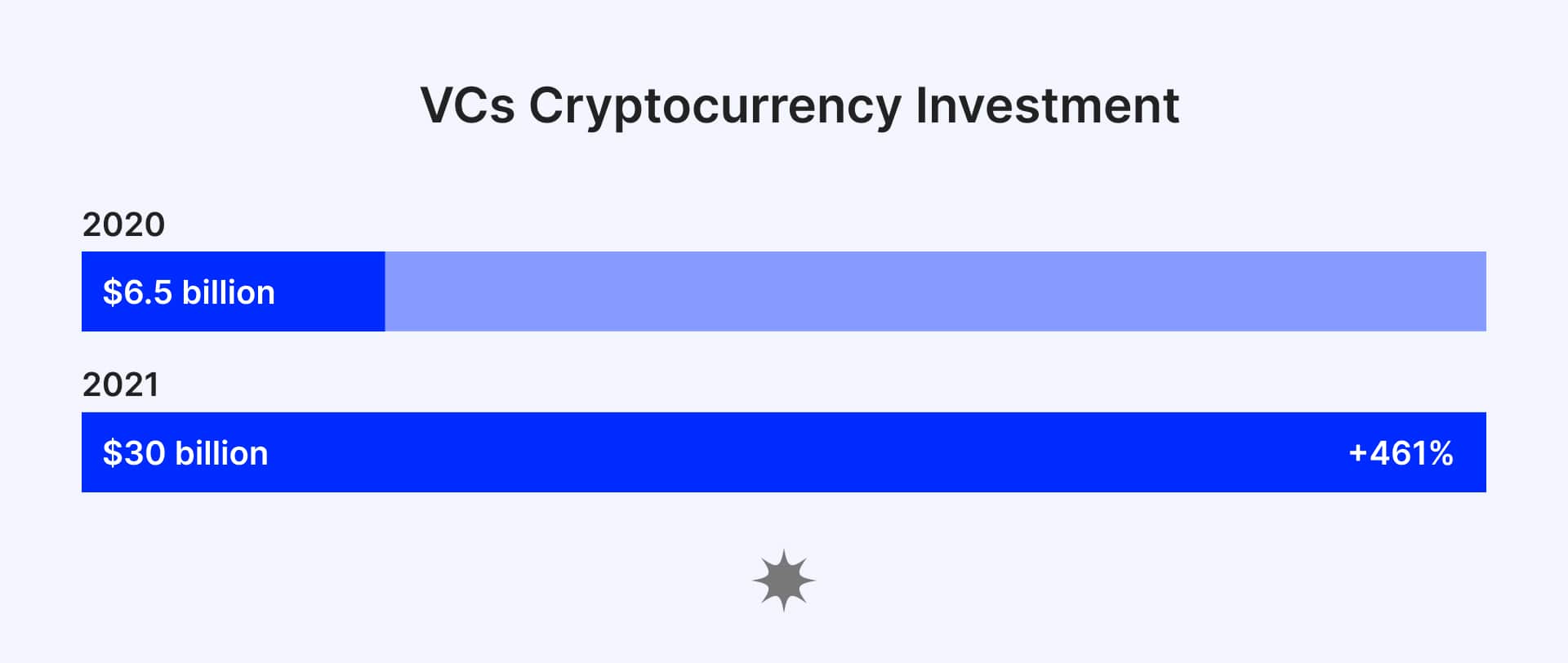

1. 2021 was a breakout for cryptocurrency. The market reached an all-time high in investments, adoption, and awareness.

2. Curiosity across the crypto asset class is high, with 41% of respondents interested in learning more about digital assets.

3. Crypto education is the key to unlocking mass adoption. 40% of respondents said they would own cryptocurrency if they knew more about it.

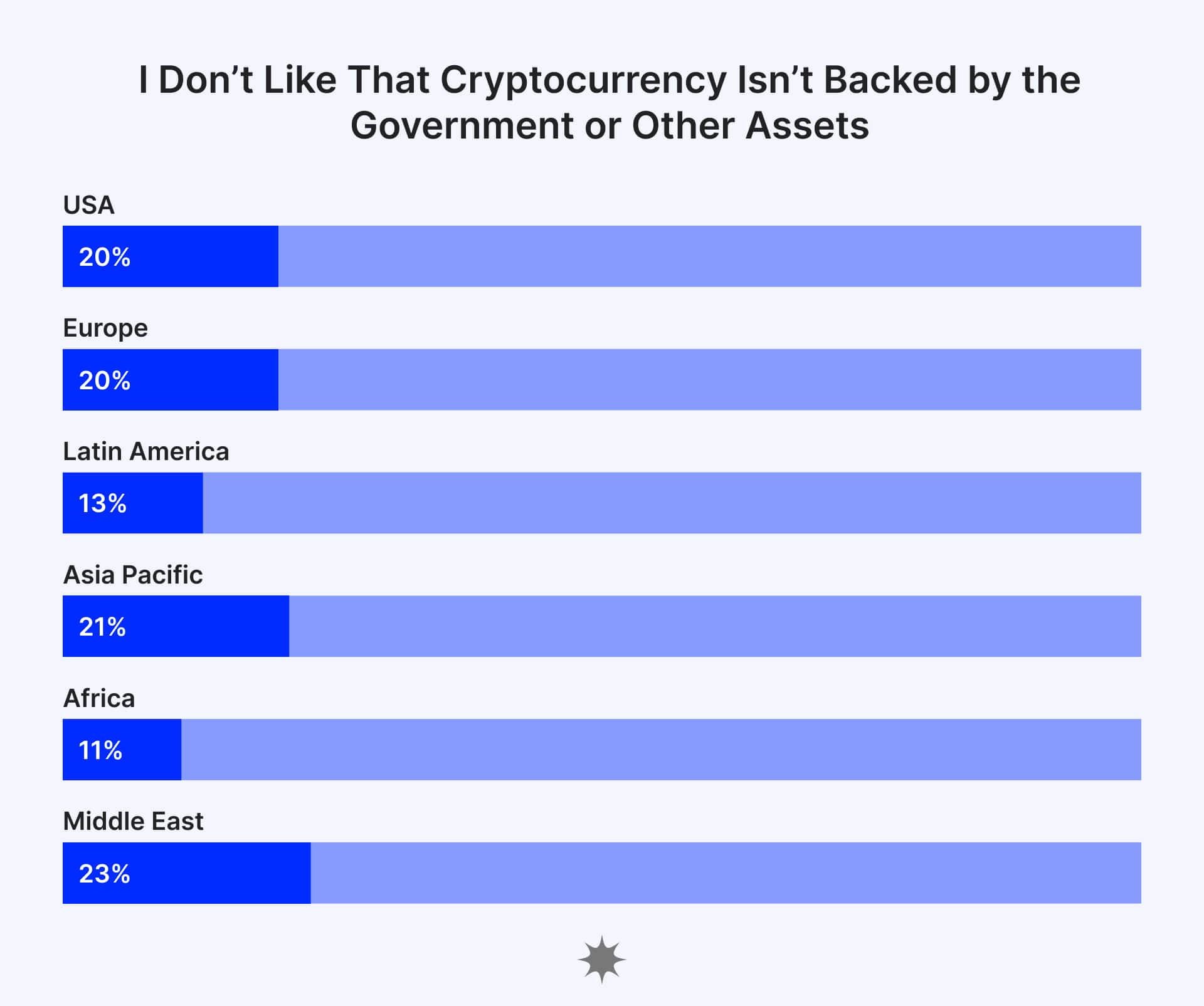

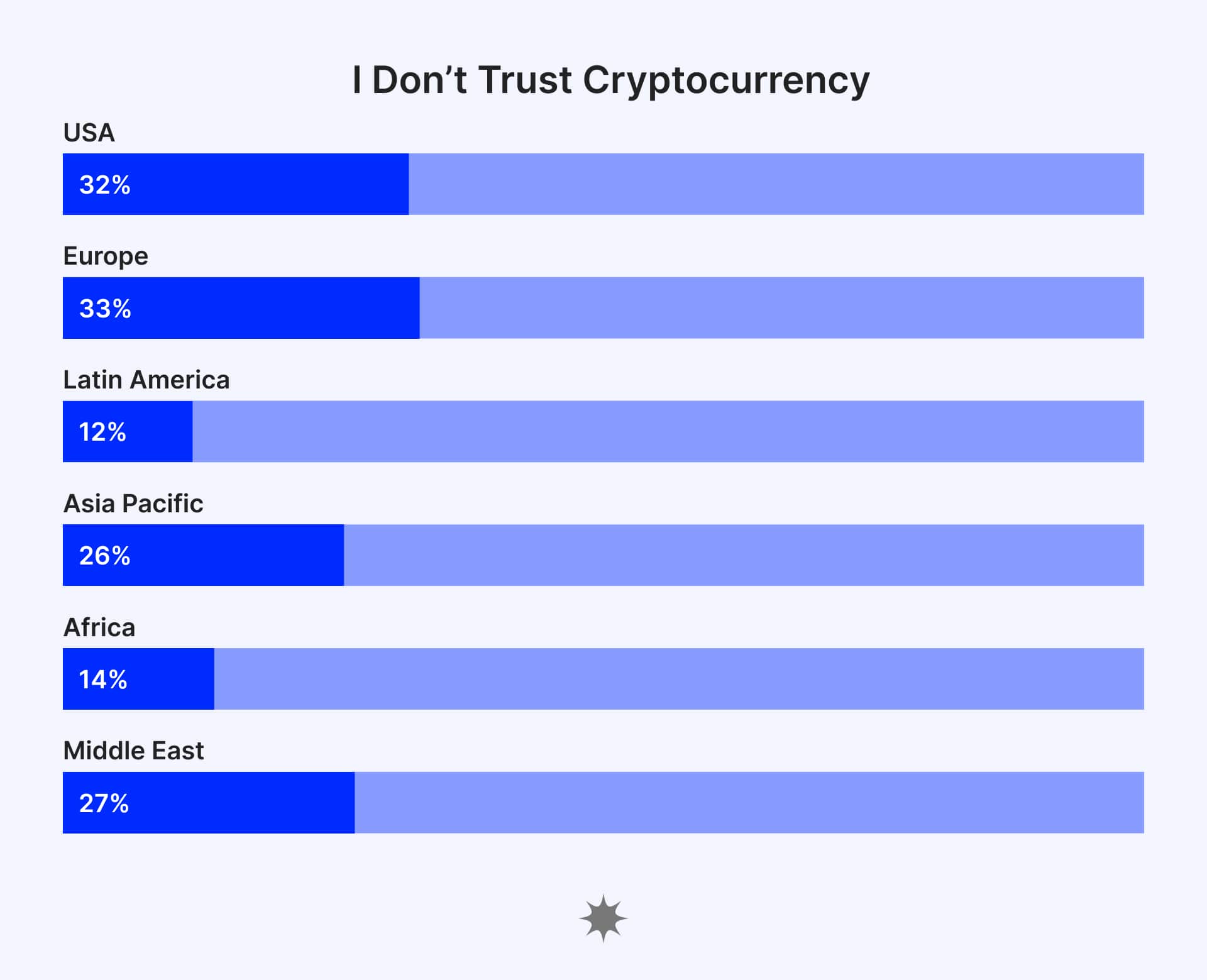

4. Security, volatility, and trust remain the top concerns for would-be cryptocurrency owners. 27% of respondents don’t own crypto because it’s too risky.

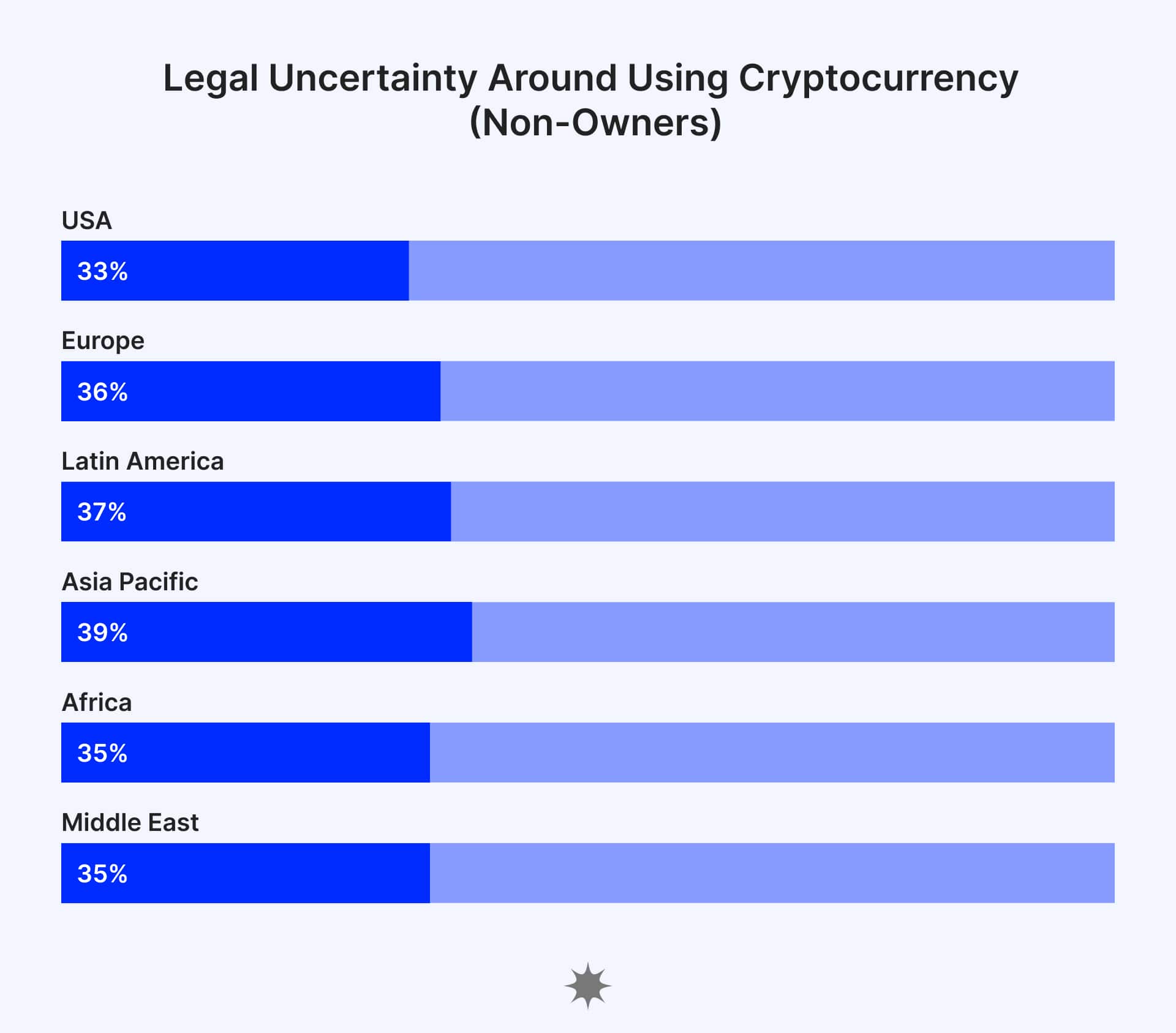

5. Regulation continues to plague the industry, with 37.3% of respondents saying that unclear regulation is a primary reason they don’t own cryptocurrency.

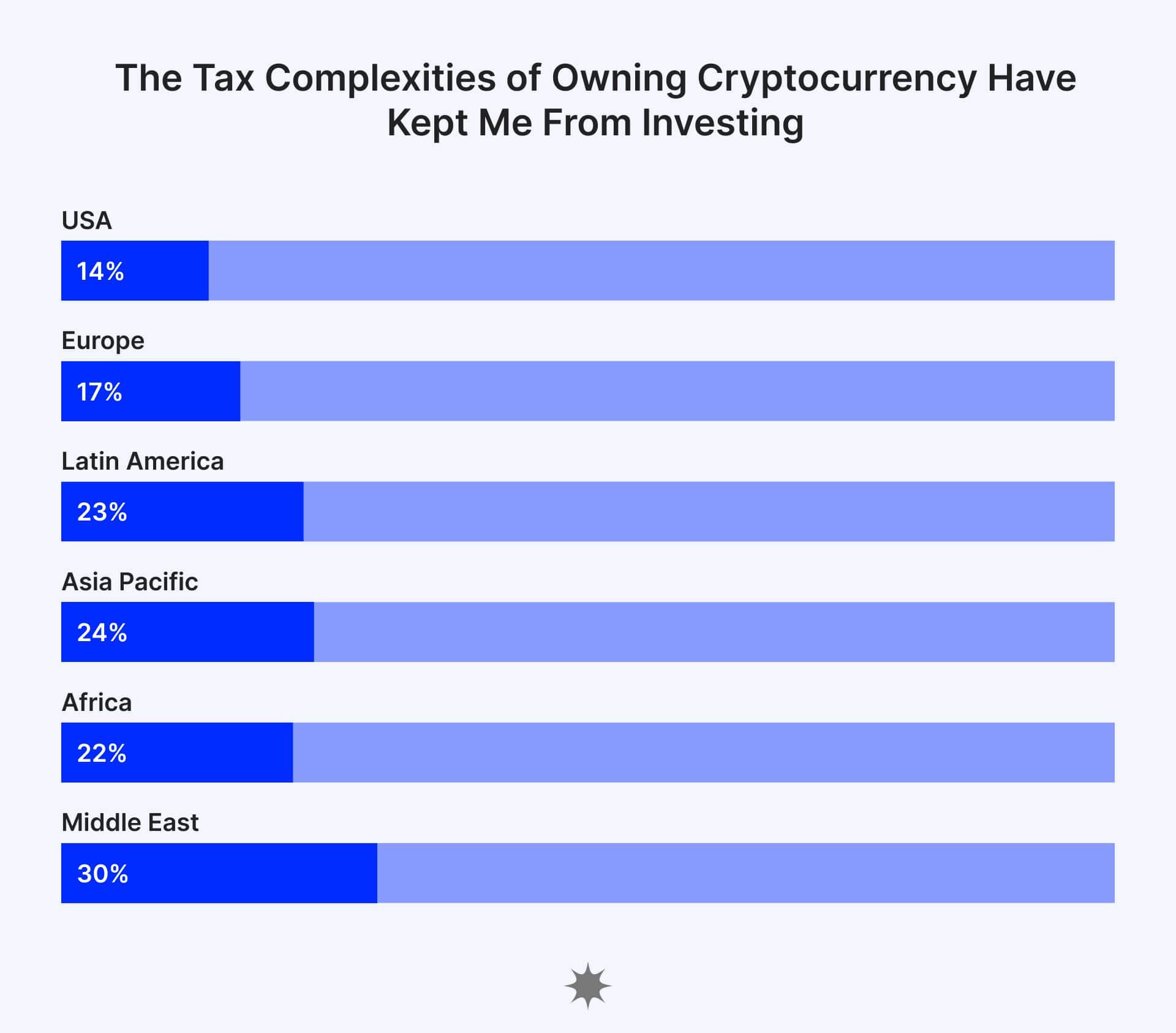

6. Tax complexities of owning cryptocurrency are also a major pain point, with around 26.0% of respondents saying it’s a primary reason they don’t own cryptocurrency.

7. The use case that resonates most with people is "hedging inflation," with 58.5% of respondents citing it as a primary reason for owning cryptocurrency.

8. Gender gap shrunk drastically in developing countries, with little difference in developed countries. The 2022 ratio was 53% and 47% for males and females respectively.

9. Diversity gap in the US continues to narrow down. 17% of Black Americans owned cryptocurrency in 2022 compared to 9% in 2020.

Let's go over these findings in more detail.

2021 was a breakout for cryptocurrency. The market reached an all-time high in investments, adoption, and awareness

Our first goal was to establish a benchmark for market awareness and cryptocurrency adoption.

We analyzed studies from the previous year and discovered:

- Cryptocurrency investment increased significantly, with $30 billion in VC funds (up from $6.5 billion in 2020).

- The total market capitalization of cryptocurrency reached an all-time high of $3 trillion in September 2021.

- Crypto was the best performing asset class in 2021, with bitcoin hitting an all-time high of over $6,8000.

- The number of active cryptocurrency wallets almost doubled since 2019 to reach over 68.42 million in 2021.

- Exact user figures for Bitcoin are not available, but the global user base of all cryptocurrencies increased by nearly 190% between 2018 and 2020

And when we looked at the data by country, we found that:

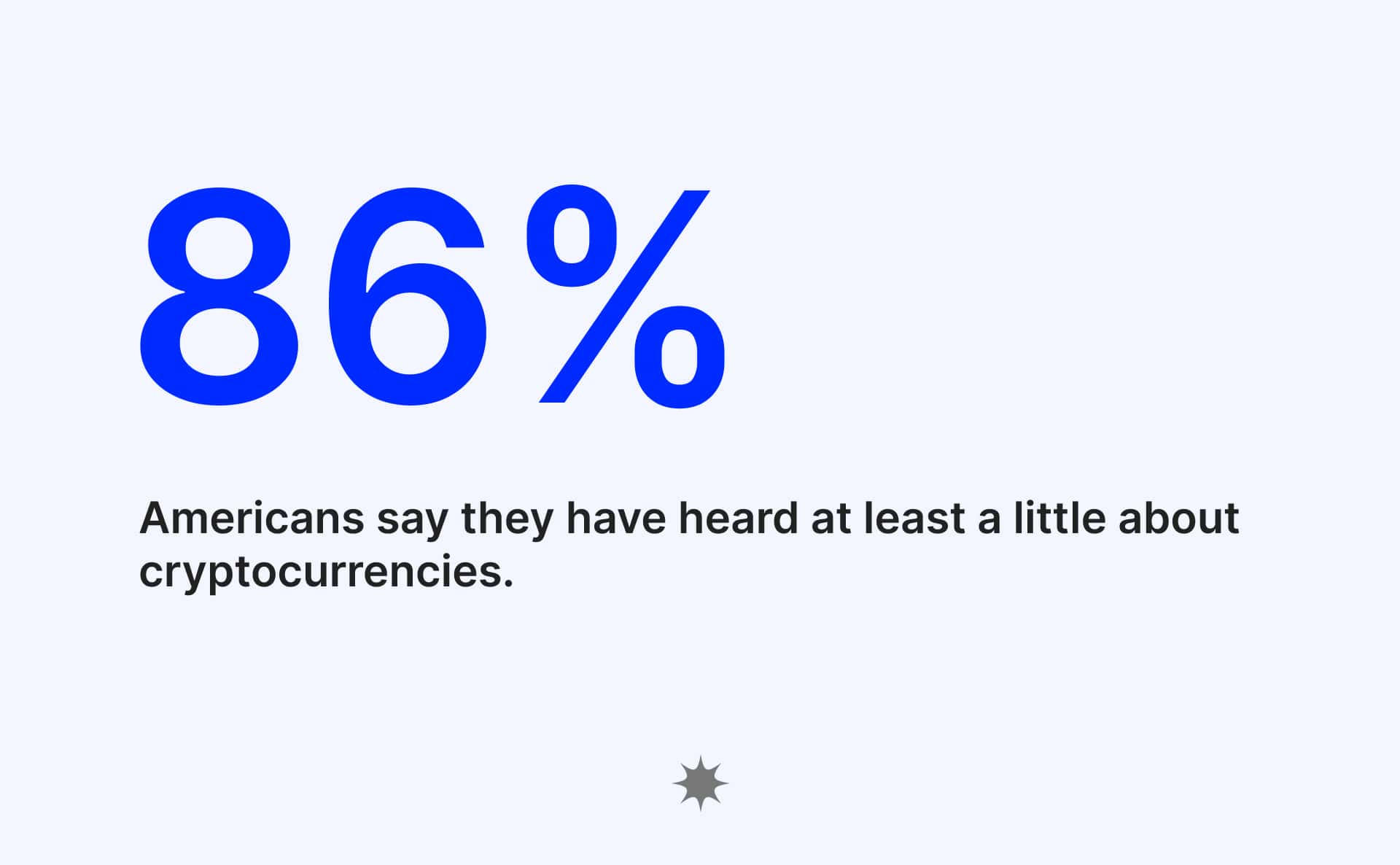

- The US leads the pack in awareness by population with 86% of Americans saying they have heard at least a little about cryptocurrencies.

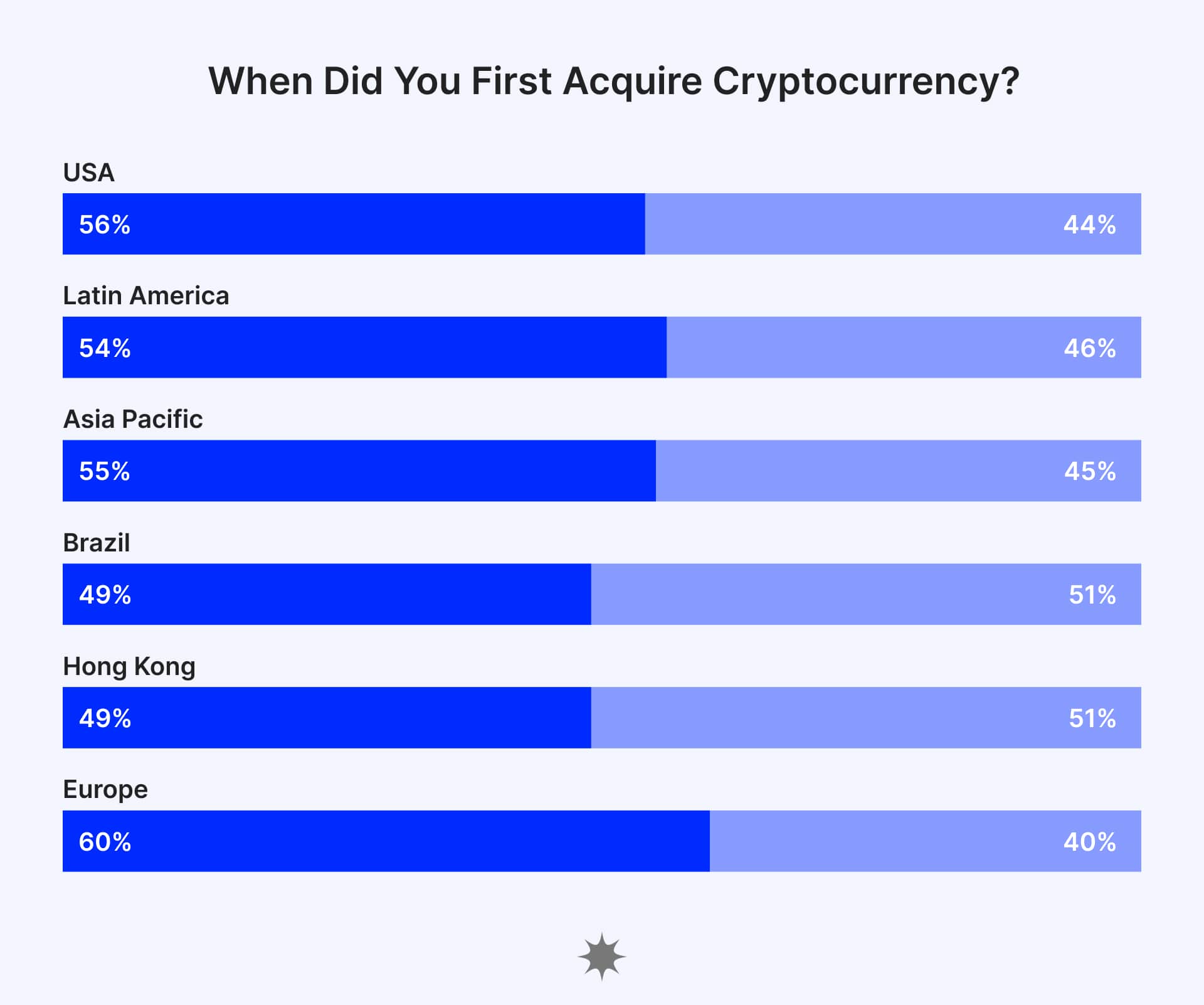

- Nearly half of all crypto owners in the United States (44%), Latin America (46%), and Asia Pacific (45%) first bought crypto in 2021.

- More than half of crypto owners in Brazil (51%), Hong Kong (51%), and India (54%) got started in 2021.

- In Europe, two in five (40%) crypto owners started investing in 2021.

This data was only a snapshot from 2021, but it’s already clear that cryptocurrency has reached a breakout in terms of awareness and adoption.

The next stage of growth will be driven by education and utility.

Curiosity across the crypto asset class is high, with 41% of respondents interested in learning more about digital assets

We also wanted to gauge people's level of interest in cryptocurrency.

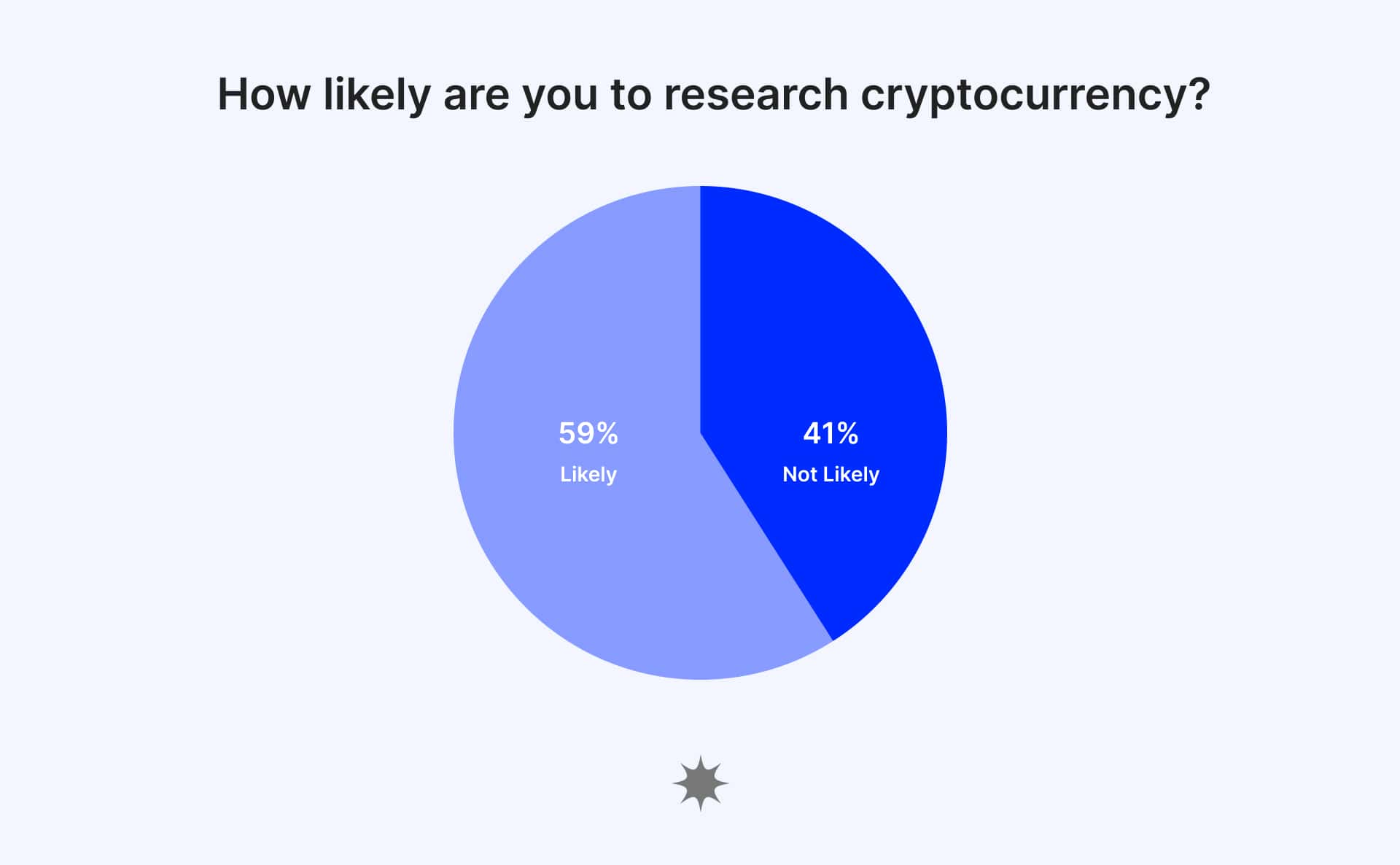

So we asked: "How likely are you to research cryptocurrency?"

41% of global respondents said they were "somewhat" or "very likely" to do so.

Note: The crypto-curious demographic do not currently own crypto, but are interested in learning or are likely to acquire cryptocurrency in the next year.

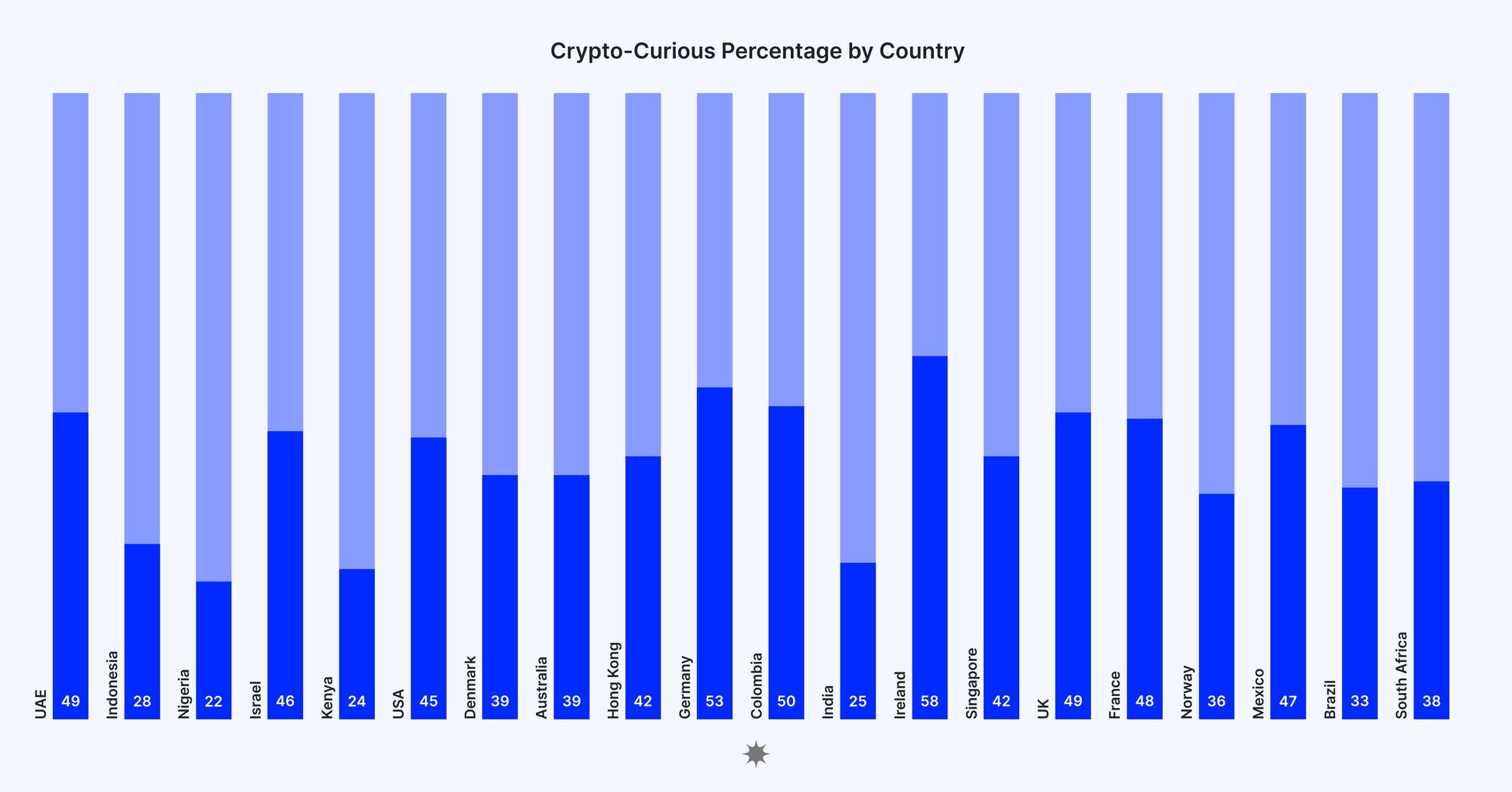

When we looked at the data by country, we found that:

- Europe had the highest percentage of crypto-curious respondents; Ireland led the pack with 58% interest. Germany (53%), the UK (49), France (48%), Denmark (39%), and Norway (36%).

- In Asia, UAE (49%), Israel (46%), Hong Kong and Singapore (42%), Indonesia (28%), and India (25) are also interested in learning more about crypto assets.

- In Africa, South Africa (38%), Kenya (24%), and Nigeria (22%) are also interested in learning more about crypto assets.

- In North America, it was Mexico (47%) and the US (45%).

- In South America, Colombia (50%), and Brazil (33%).

- In Oceania, Australia (39%)

However, awareness does not always equate to understanding.

Crypto education is the key to unlocking mass adoption.

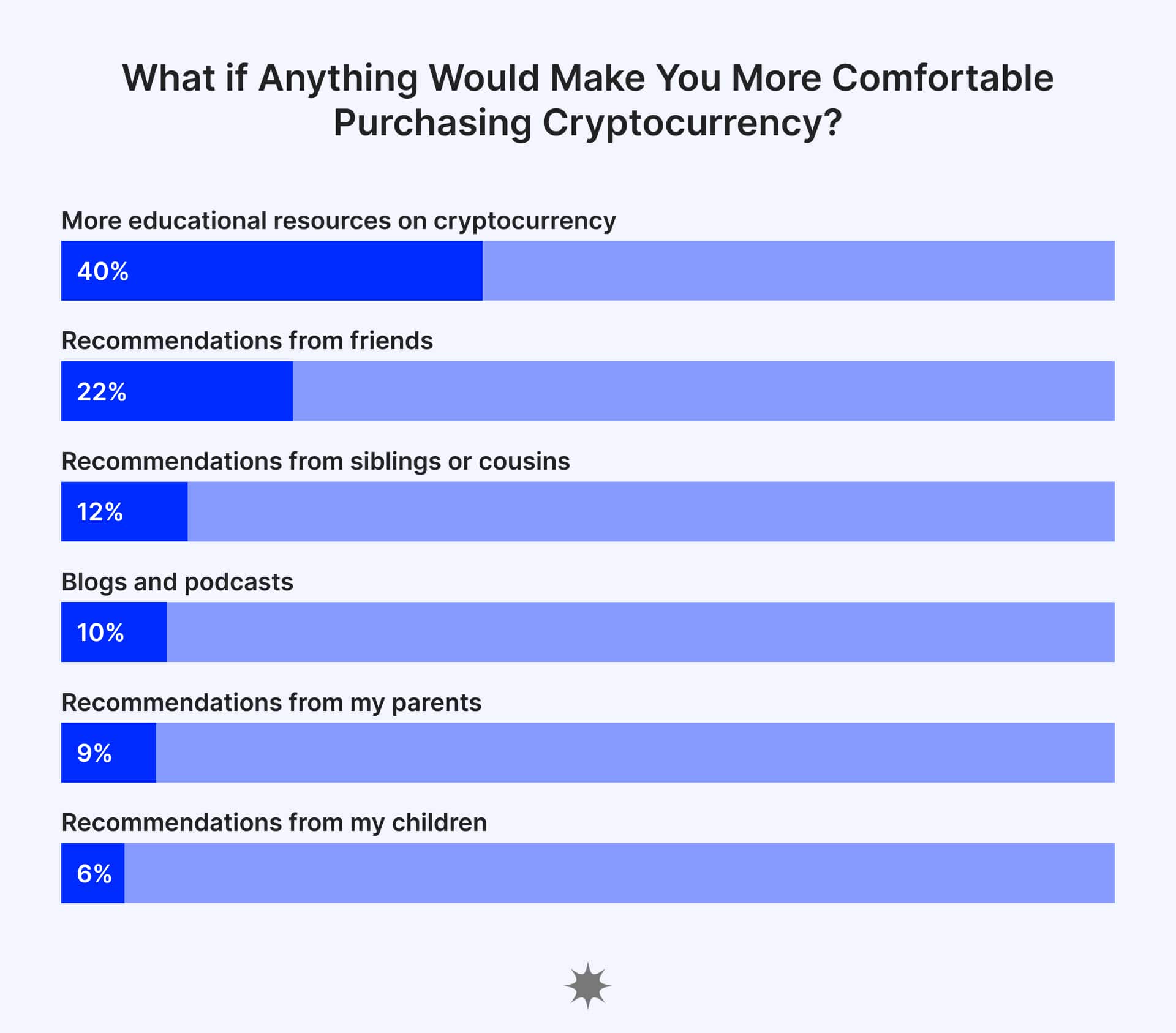

We also asked people "What if anything would make you more comfortable purchasing cryptocurrency?".

Globally, the most popular reason was "Educational resources".

Educational resources (40%) would help twice more people invest than those who said they needed a recommendation from friends (19%).

Other popular reasons included recommendations from "siblings or cousins" (12%), "blogs and podcasts" (10%), "parents" (9%) and "children" (6%).

Truth is, there are plenty of resources out there.

The problem is that people don't know where to look, or they're overwhelmed by the amount of information.

While most tutorials and guides are helpful, others treat this asset class as a get-rich-quick scheme.

To ensure that people get the education they need, we've compiled a list of trustworthy resources in our next article.

Also alongside education, if platform UIs can be more beginner-friendly it'll go a long way to help new investors feel comfortable and familiar with the space.

In short, we need more education and utility to drive the mass adoption of cryptocurrency.

And we need it now.

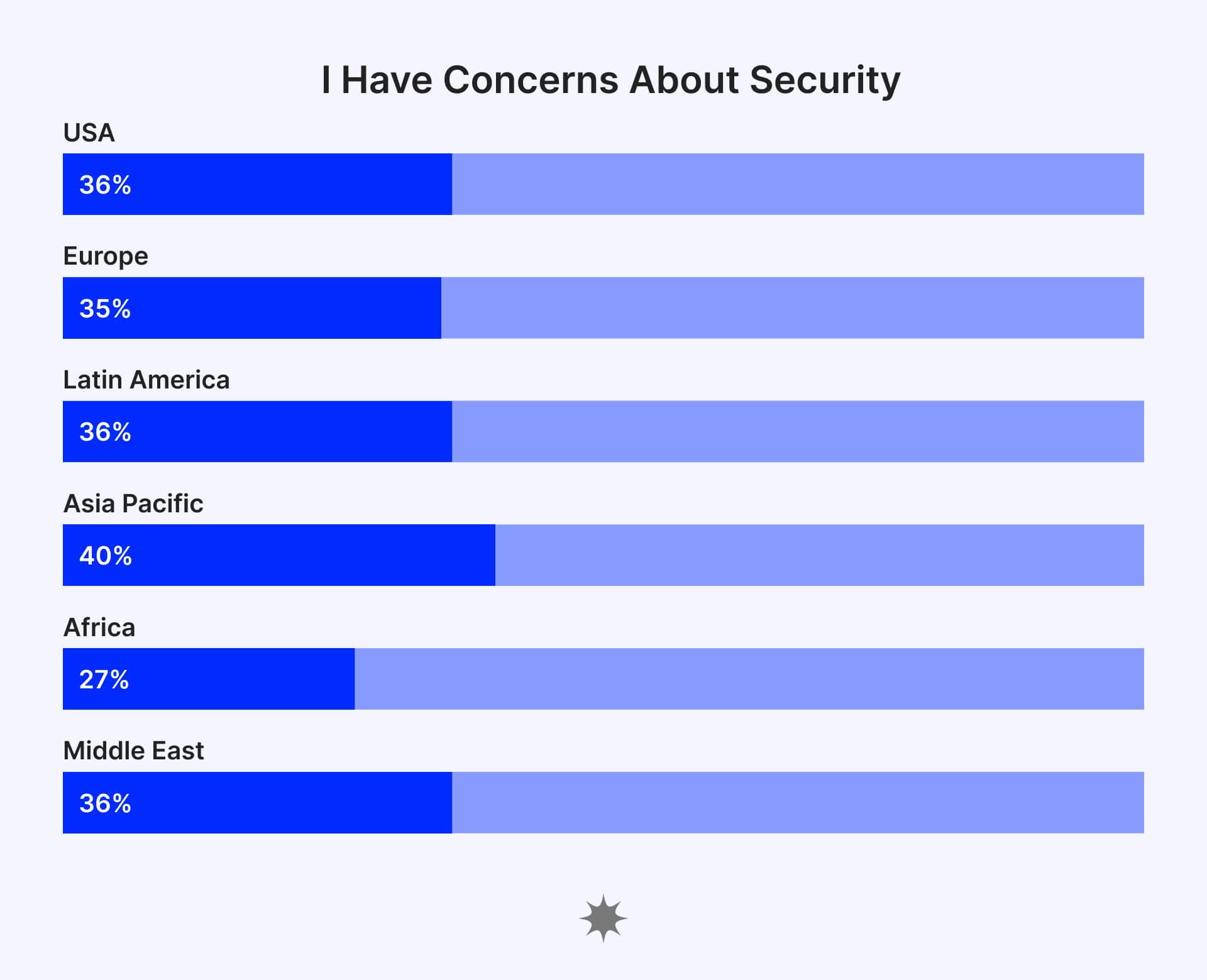

Security, volatility, and trust remain the top concerns for would-be cryptocurrency owners.

Next, we wanted to know what's holding people back from buying cryptocurrency.

We asked, "What are your top concerns when considering purchasing cryptocurrency?".

The most popular response, selected by 27% of respondents, was "It's too risky".

"I don't know how to purchase it" (15%), "I'm afraid I'll lose money" (14%), and "I don't trust cryptocurrency" (12%) were also popular responses.

When we considered regional data, we found that "I don't trust cryptocurrency" was the top concern in Europe (16%), Asia (15%), and Africa (14%).

"It's too risky" was the top concern in North America (31%) and South America (28%).

"I'm afraid I'll lose money" was the top concern in Oceania (19%).

These results suggest that a lack of trust and understanding are key barriers to entry for would-be cryptocurrency investors.

In our next article, we'll be exploring these issues in more depth and offering some solutions.

Stay tuned!

Regulation and Tax complexities continue to plague the industry.

Next, we wanted to know what people thought about the role of government in the cryptocurrency industry.

Among non-owners, 39% in the Asia Pacific, 37% in Latin America and 36% in Europe say there is legal uncertainty around cryptocurrency.

In Africa, 35% of non-owners say that a lack of regulation is a primary reason they don’t own cryptocurrency.

In North America, 34% of non-owners are concerned about government interference.

In addition, for 30% of respondents in the Middle East, 24% in the Asia Pacific, and 23% in Latin America, the tax complexities of owning cryptocurrency have kept them from investing in crypto.

These results suggest that regulatory uncertainty is a key barrier to entry for would-be cryptocurrency investors.

The use case that resonates most with people is "hedging inflation," and diversification.

But why are people buying cryptocurrency?

We asked, "What are your primary reasons for owning cryptocurrency?".

The most popular responses, selected by Latin America (59%) and Africa (58%) were "To hedge against inflation".

But these places have something in common: long-term hyperinflation.

Respondents from hyper-inflated economies are 5 times more likely to own cryptocurrency than those from economies with low inflation.

Some countries with high valuation include South Africa (102.74%), Mexico (63.71%), India (58.58%), and Brazil (217.65%).

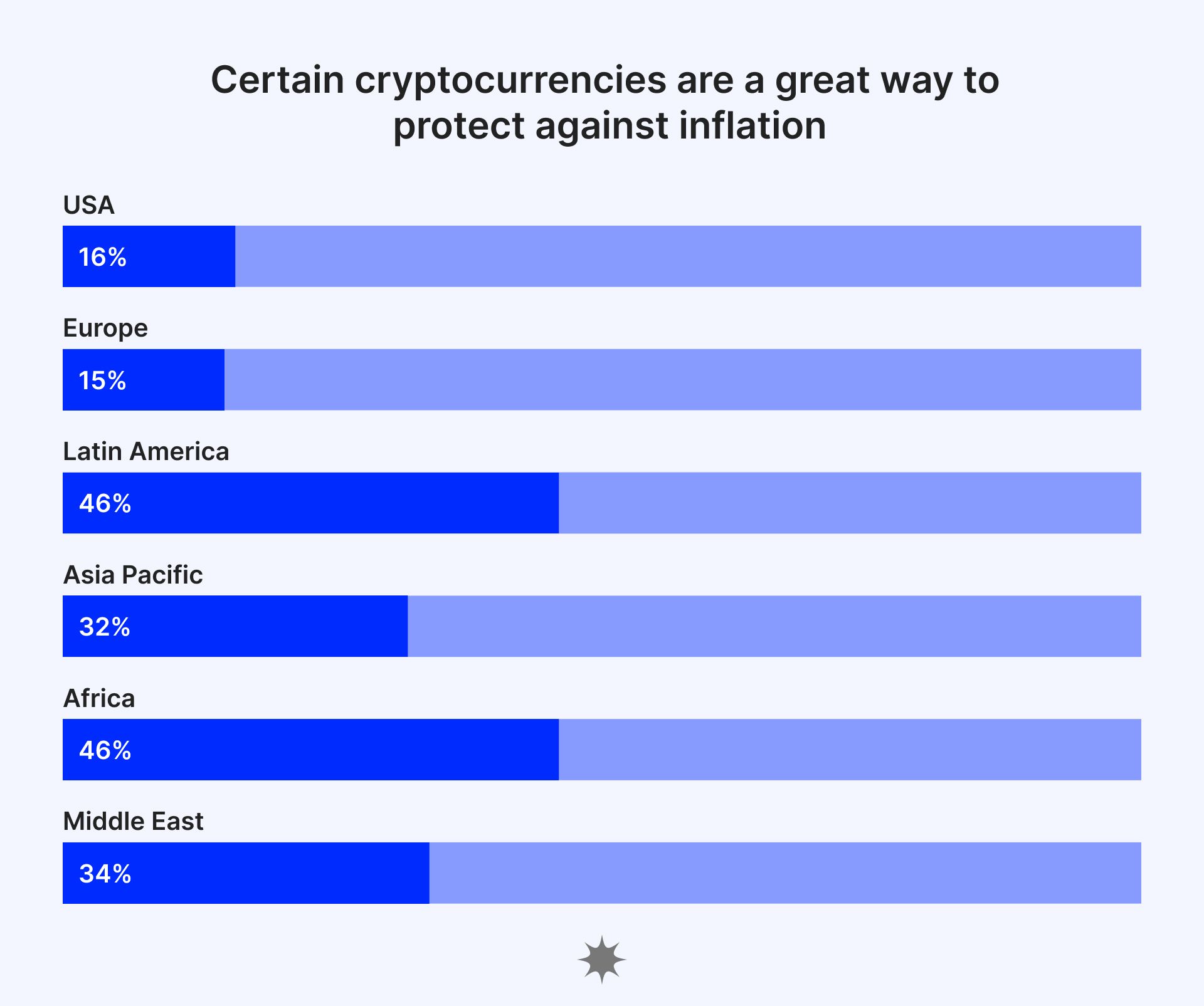

46% of Latin Americans and Africa are certain cryptocurrencies are a great way to protect against inflation.

Regions with relatively less deflation are less likely to believe in cryptocurrencies as a good way to protect their savings against inflation.

For example, only 16% in the US and 15% in Europe think that crypto is a good way to save.

Behind inflation is diversification.

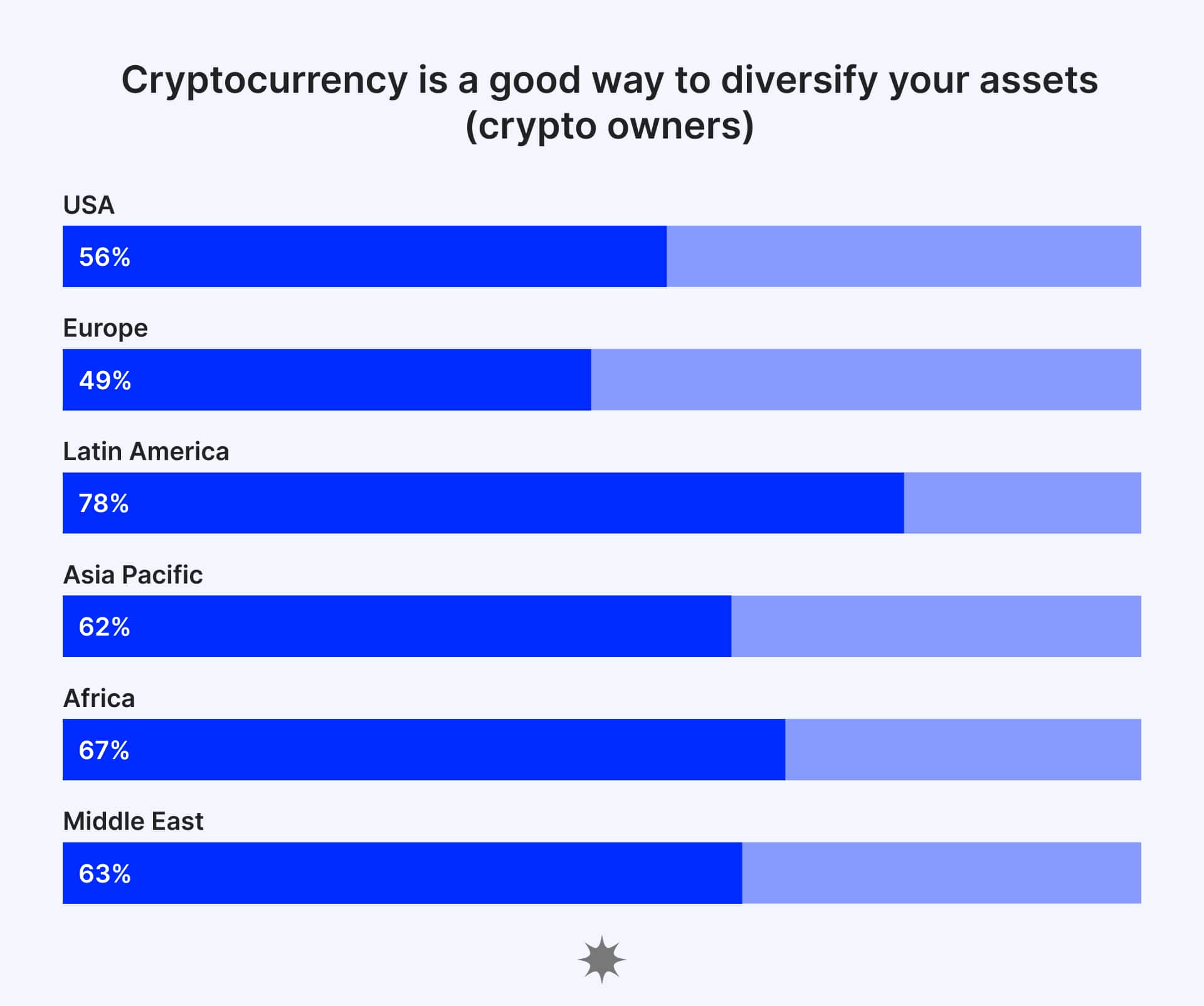

Crypto owners in every region, especially Latin America (78%) believe cryptocurrency is a good way to diversify their investment portfolio.

North Americans are split on the issue, with 44% of crypto owners and 42% of non-owners saying they believe in crypto as a form of diversification.

In Europe, 47% of crypto owners believe in using cryptocurrency as a form of portfolio diversification, compared to just 27% of non-owners.

The use case that resonates most with people is "hedging inflation," and diversification. In our next article, we'll be exploring these issues in more depth and offering some solutions. Stay tuned!

Crypto gender and diversity gap shrunk down.

How about gender and cryptocurrency adoption?

Historically, there's been a steep skew in gender participation and the cryptocurrency community.

In general, men are still more likely to own cryptocurrency than women, but it's no longer a steep skew.

The biggest gap is in developed regions where only a third of current crypto owners are women, including in the United States (32%), Europe (33%), and Australia (27%).

Women in developing nations led the way with women representing at least half of crypto owners in Israel (51%), Indonesia (51%), and Nigeria (50%).

Alongside gender is diversity, or the lack thereof.

The survey found that people of color are still considerably less likely to own cryptocurrency than white people.

Nearly twice as many surveyed Black Americans reported owning cryptocurrency (17%) when compared to 2020 (9%).

Similarly, nearly one in four (22%) of surveyed Hispanic or Latino Americans own cryptocurrency, compared to just 13% in 2020.

However, when compared to 2020, there was no significant change in ownership rates for white or Asian people.

This data suggests that the cryptocurrency community is becoming more diverse, but there's still a long way to go.

Conclusion

In conclusion, the data shows that there is a high level of interest in cryptocurrency, but a lack of understanding remains a key barrier to adoption.

Education is critical to unlocking the mass adoption of digital assets.

Security, volatility, and trust concerns also need to be addressed in order for more people to feel comfortable investing in crypto.

Regulation and tax complexities are also major pain points that need to be addressed.

Finally, people are beginning to see cryptocurrency as a viable alternative to fiat currency.

With all of this in mind, we believe that 2022 will be another breakout year for the cryptocurrency market. Stay tuned for more exciting developments!

Subscribe for more great content about cryptocurrency!

Resources

Gemini: 2022 State of Crypto